|

FAQs

I am over the age of 70 and have been told to stay home so how do I access food?

There are numerous services such as grocery delivery that will enable you to do this. Funding is also being injected into these services to enable the people who need them most to have access.

Groceries

Takeaway

Many local businesses also have their own delivery services operating. You can call local businesses and ask what is available.

Community organisations providing assistance

Usually this service would only be available to people with a My Aged Care number however they are now extending the service to include anyone over 65 affected by the coronavirus restrictions for a period of up to 6 weeks.

Call the below of the service closest to you and a representative will ask a series of questions to determine specific needs and then proceed to assist.

Hornsby 9482 2088, Hills Shire 9761 7600

- Hornsby Community Transport

Hornsby Community Transport can pick up and deliver goods; food, pharmaceuticals etc., if they are paid for and ready to pick up.

The number to call 9983 1611 (all messages will receive a call back so encourage that they leave a voicemail)

If you are struggling to make ends meet, you may be able receive help from one of the following organisations (however this is not an exhaustive list of organisation assisting in our community):

During these difficult and challenging times, where many people are experiencing economic hardship and uncertainty, the Salvation Army remains committed to assist vulnerable people with basic necessities as best we are able.

Through the generosity of Harris Farm, Pennant Hills and Baker’s Delight, Berowra, the Salvation Army at Hornsby MAY BE able to assist with fruit, vegetables and bread. Please note that our supplies are limited.

If you require assistance, please contact the Salvation Army at Hornsby on 02 9477 1133 option “2” Monday to Friday between 10am-2pm.

Call 9477 5022 to receive food parcels and food vouchers. They will soon have digital vouchers that can be used to order with supermarkets on-line.

- Hornsby Connect do not deliver but are still providing food to those who need it. You must be registered – you can register online and they are providing food from 9am to 2pm on Wednesdays. Visit hornsbyconnect.org.au for more information.

- Other agencies you can call:

- CatholicCare – 9488 2406

- Mission Australia – 9480 2506

- Lifeline – 9489 2757

Can I get tested for coronavirus?

Previously the advice was that you only needed to get tested for COVID-19 if you have developed symptoms and have returned from overseas in the previous 14 days or if you have been in contact with someone with COVID-19 and develop symptoms.

The eligibility criteria for coronavirus testing has been expanded to include the following:

- all health workers

- all aged/residential care workers

- geographically localised areas where there is elevated risk of community transmission as defined by the local public health unit.

- where no community transmission is occurring, high risk settings where there are two or more plausibly-linked cases, for example:

- aged and residential care

- rural and remote Aboriginal and Torres Strait Islander communities

- detention centres/correctional facilities

- boarding schools

- military bases (including Navy ships) that have live-in accommodation.

I have a pet and am wondering what I do if I get sick – will vets remain open?

Vets have been classified as an essential service and will remain open. Where possible, they will consult online so phone ahead.

I own an investment property – what will happen to me?

For the next six months, tenants cannot be evicted because of being unable to pay rent as a result of coronavirus. The Government is aware that this could put some landlords in a financially untenable situation. More announcements about landlord/tenant matters will be made. However landlords are encouraged to discuss arrangements with to tenants and banks in the first instance.

I am a self-funded retiree. What support is there for me?

The Government has reduced the draw-down rate for account-based pensions so that you can sell fewer assets to top up your income, than you would need to under normal circumstances.

The Government will also cut the deeming rate by 25 points on the first of May. The lower deeming rate will be 0.25% and the upper deeming rate will be 2.25%

If your assets and income drop below the eligibility threshold you may also become eligible for the age pension. You can investigate this at: https://www.servicesaustralia.gov.au/individuals/services/centrelink/age-pension

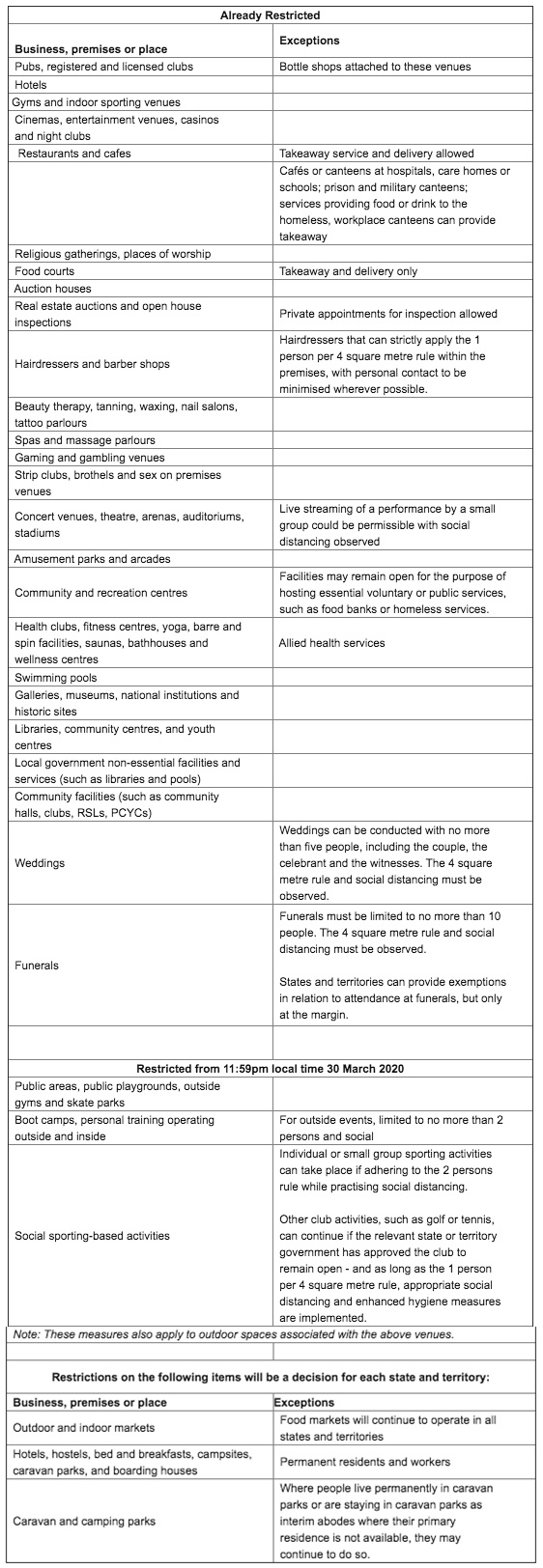

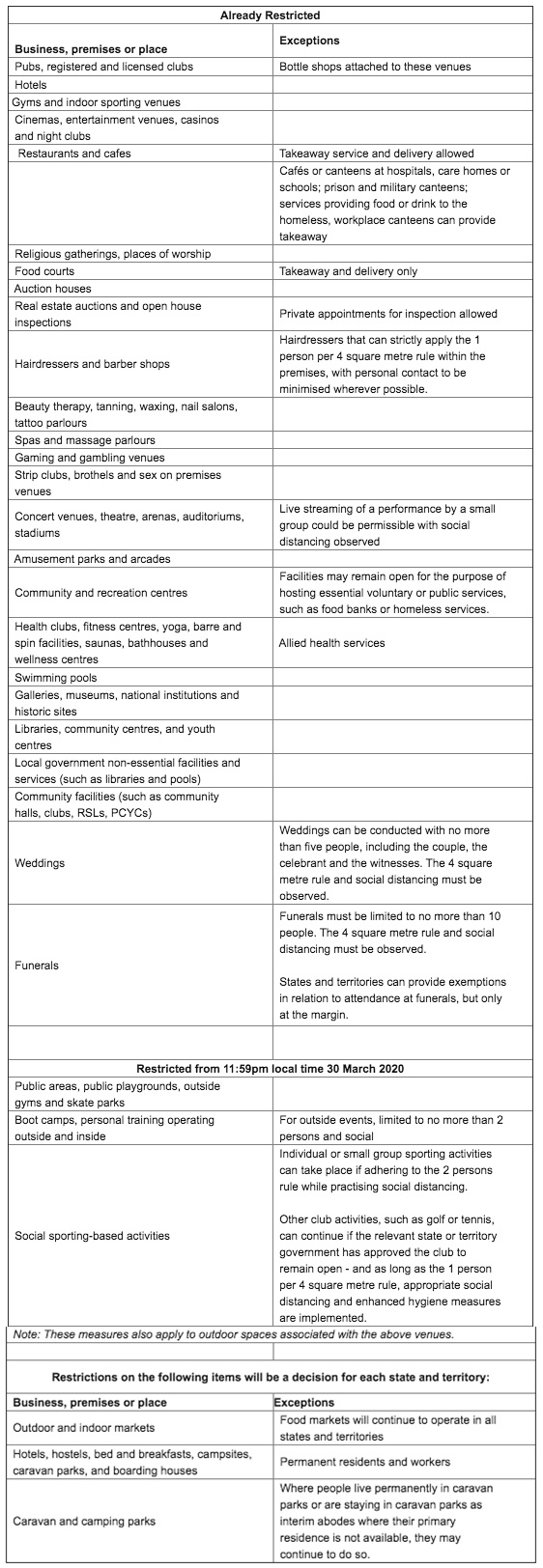

What businesses, premises or places are now restricted?

Some businesses, organisations and places encourage people to congregate and therefore pose a particular risk. The operation and access to these have necessarily been restricted. The table below outlines the restrictions. In all situations, including workplaces, Australians should practice good hygiene and social distancing wherever possible by keeping 1.5 metres apart from others and applying the 4 square metre per person rule.

An updated schedule on the businesses that are now restricted and the exceptions is below:

|